You can use the Employee Affordability Estimator to determine the affordability of if your employer's coverage. It is considered affordable if the amount of the monthly premium of the lowest-cost plan offered is less than the percentage set by the IRS of your total household income. This estimator help you assess if you may be eligible for a tax credit and coverage through Your Health Idaho.

https://affordability.yourhealthidaho.org/#/

Landing Page

The estimator’s landing page provides basic information and the information you will need to answer a few questions.

Household Members Page

You will first be asked to provide general information about yourself, including your first name, age, and whether you are employed or pregnant.

You can then add other household members, including and dependents.

The estimator displays helpful tips along the way. For instance, it reminds you to only add family members who are claimed on your taxes even if they do not need coverage, or to contact Your Health Idaho customer service if you or a household member has two or more jobs that offer health coverage.

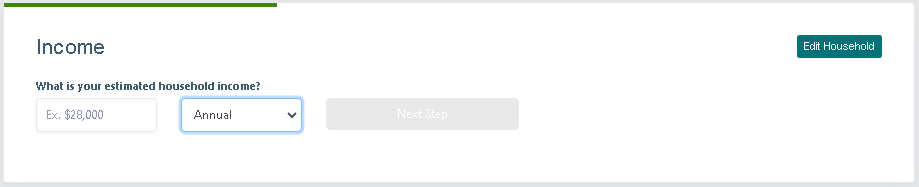

Income Page

Next, you will be asked to provide your estimated household income. Here, you can click a dropdown to indicate the income's frequency. You can select annually, monthly, bi-weekly, or weekly.

Coverage Details Page

For each household member you indicated is employed, you will be asked if that member’s employer:

- Doesn’t offer health coverage

- Offers health coverage to the employee only

- Offers health coverage to the employee and dependent children—but not the spouse

- Offers health coverage to the employee, spouse and children

If you answer that any family member’s employer offers coverage to at least that member, you will then be asked questions regarding the monthly premium amount paid for the family member employed and then for the others looking for coverage.

Selecting “Less than...”

- By selecting the less than option, the estimator will then ask if the plan meets the minimum value standard. If you are not sure, you can click “click here” to visit the Your Health Idaho Help Center with information about the Minimum Value Standard or contact your company's HR or benefits specialist to get more information.

- After indicating “Yes” or “No,” you can continue to the next employed member or see the results if the questions were answered for all employed family members.

Selecting “More than...”

- After indicating “More than...,” you can continue to the next employed member or check the results if there are no more employed family members.

Results Page

The estimator provides an eligibility result for each member based on the information you provided. You will receive a result for each family member.

- (Member) is offered affordable employer coverage – Not Your Health Idaho eligible

- Displays if the employer health plan offered to that member is considered affordable

- (Member) is not offered affordable employer coverage – may be Your Health Idaho eligible

- Displays if the employer health plan offered to that member is considered unaffordable and the member’s household income is above Medicaid/CHIP thresholds.

- (Member) is not offered affordable employer coverage – CHIP eligible

- Displays if the employer health plan offered to that member is considered unaffordable and the member’s household income is within CHIP thresholds.

- (Member) is not offered affordable employer coverage – Medicaid eligible

- Displays if the employer health plan offered to that member is considered unaffordable and the member’s household income is within Medicaid thresholds.

- (Member) is offered affordable employer coverage – Medicaid eligible

- Displays if the employer health plan offered to that member is considered affordable and the member’s household income is within Medicaid thresholds.