What is an Advance Premium Tax Credit?

The Advance Premium Tax Credit (APTC) acts as an instant discount to cover some or all the monthly costs for health insurance coverage. Idahoans seeking an Advanced Premium Tax Credit must apply with and enroll in coverage through Your Health Idaho.

Your Health Idaho relies on self-attested information and documented proof of your information to determine your eligibility for an APTC.

It’s important to note that an APTC is estimated based on the information you report to us for that plan year. Reporting changes as they occur is key to receiving an accurate tax credit amount.

How is APTC Calculated?

To calculate the amount of APTC you are eligible for, Your Health Idaho is federally mandated to use specific information about your household (HH). This includes but is not limited to:

HH size

HH Income

Address

Number of people in the HH seeking coverage

Medicaid\CHIP eligibility

There is no set guaranteed amount for an APTC. If your household information changes, so may your eligibility and tax credit amount.

When is APTC Calculated?

Your Health Idaho checks your eligibility for an APTC when you submit a new application or report changes.

If you’ve given consent to Your Health Idaho to access your income information electronically, your eligibility will be automatically redetermined for coverage renewal each year.

Re-calculation of your APTC ensures you are receiving the correct tax credit amount and mitigates your tax liability at the end of the year.

Is my tax credit permanent?

No, your tax credit eligibility is redetermined if there are changes to your household information during the year or each year you renew your coverage.

My tax credit was denied or removed. Why?

Below are some common occurrences that result in an APTC being denied or removed:

Your household income is too high or too low

For most Idahoans, your modified adjusted gross income must be between 139% and 400% of the Federal Poverty Level.

You are potentially eligible for Medicaid

If a member of your household was receiving APTC and is determined eligible for Medicaid, they are no longer eligible for an APTC. This can happen during, after, or independently of the application process.

You have access to affordable Employer Coverage

Idahoans who are offered affordable employer-sponsored coverage will be denied an APTC.

Other requirements were not met when completing an application

If you answered “No” to the following questions on your application, you are not eligible for APTC.

Do you want to find out if you can get help paying for health coverage?

Do [Spouse A] and [Spouse B] plan to file a joint federal income tax return for [Year]?

Did [Tax filer] reconcile premium tax credits on their tax returns for past years?

If you answered “Yes” to the following questions on your application, you are not eligible for APTC.

Is [applicant] offered Idaho state employee benefit plan through a job or a family member's job?

Is [Consumer Name] currently enrolled in health coverage that will extend beyond 60 days from today?

Your Health Idaho did not have your authorization to re-evaluate your eligibility for the tax credit during the renewal period.

You can authorize Your Health Idaho to re-evaluate your eligibility for an APTC before the start of a plan year for a maximum of 5 years. If that authorization expired or you did not authorize Your Health Idaho to re-evaluate your eligibility, you will lose your tax credit if you do not manually renew your application.

My tax credit is lower than it was before. Why?

Reporting changes, such as a change in household makeup or income, may result in a change in your tax credit amount. Your tax credit may decrease if the reported changes adjust your eligibility. For example, a higher income may reduce the amount of tax credit you receive.

Any changes made to your APTC amount are made in line with Federal Regulations to mitigate your tax liability at the end of the year.

Manually changing your tax credit amount.

By default, Your Health Idaho will apply the whole amount of APTC you’re eligible for toward your premium. Some Idahoans elect to voluntarily withhold their APTC with the intention of claiming the amount not applied toward their premiums at the end of the tax year.

Withholding your APTC is one way to safeguard against unforeseen circumstances that may change your APTC amount during the year. This method may benefit someone whose estimated income for the tax year is difficult to determine.

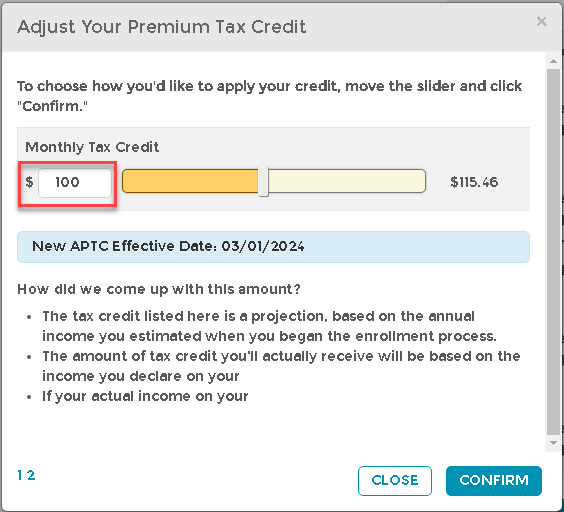

The changes you make to your APTC can only be applied beginning your next month of coverage and going forward.

NOTE: You cannot claim more unused tax credit than the sum of your eligible premiums for the year.

To modify your APTC amount, follow the steps below:

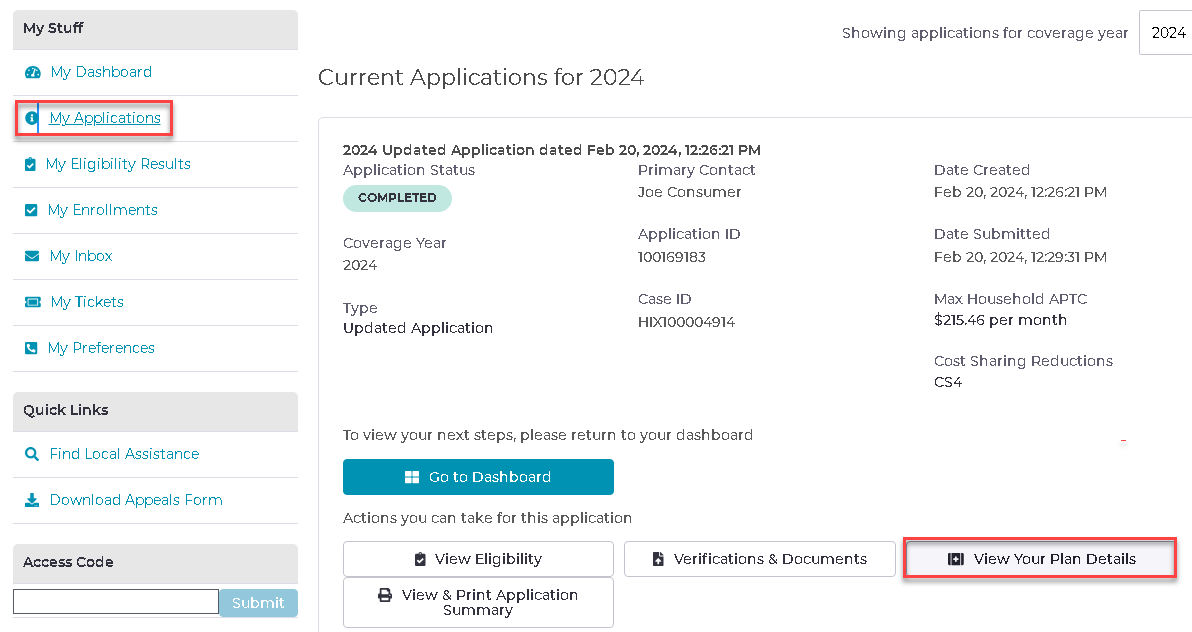

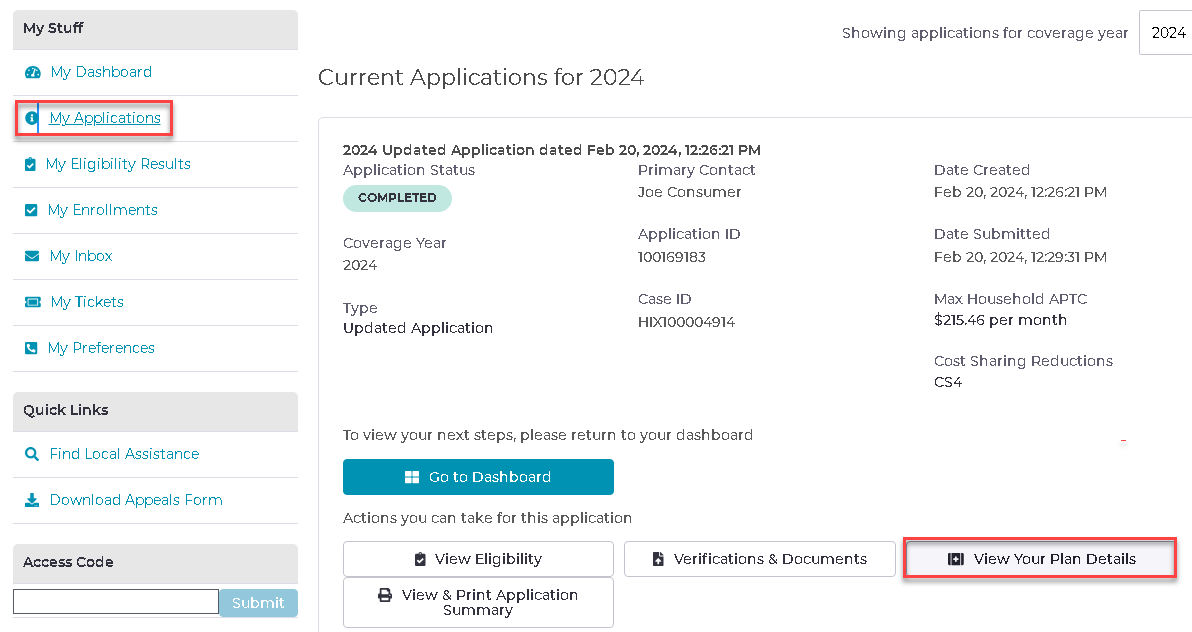

Click My Applications from the navigation tab.

Locate your current plan.

Click View Your Plan Details

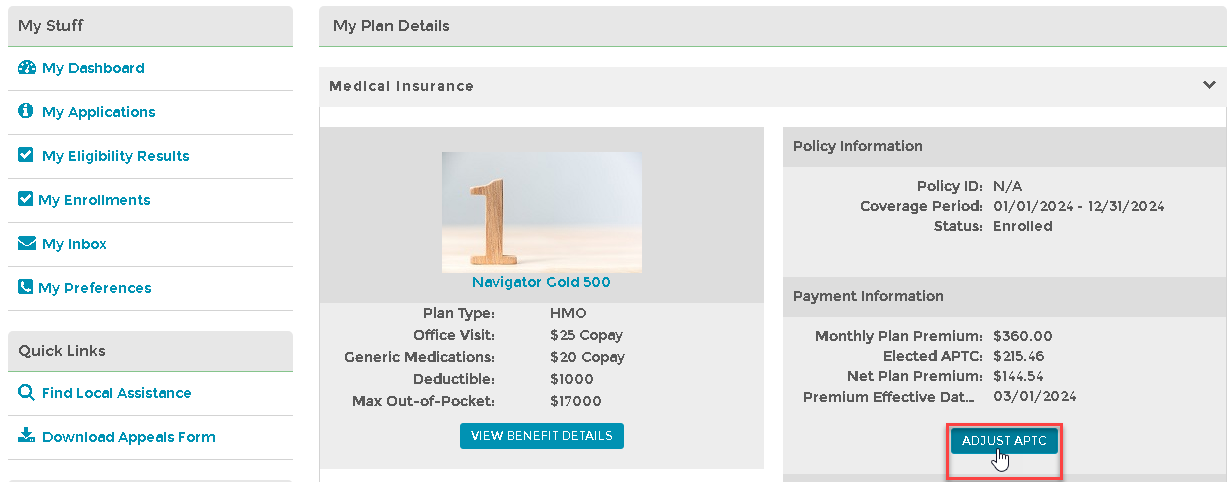

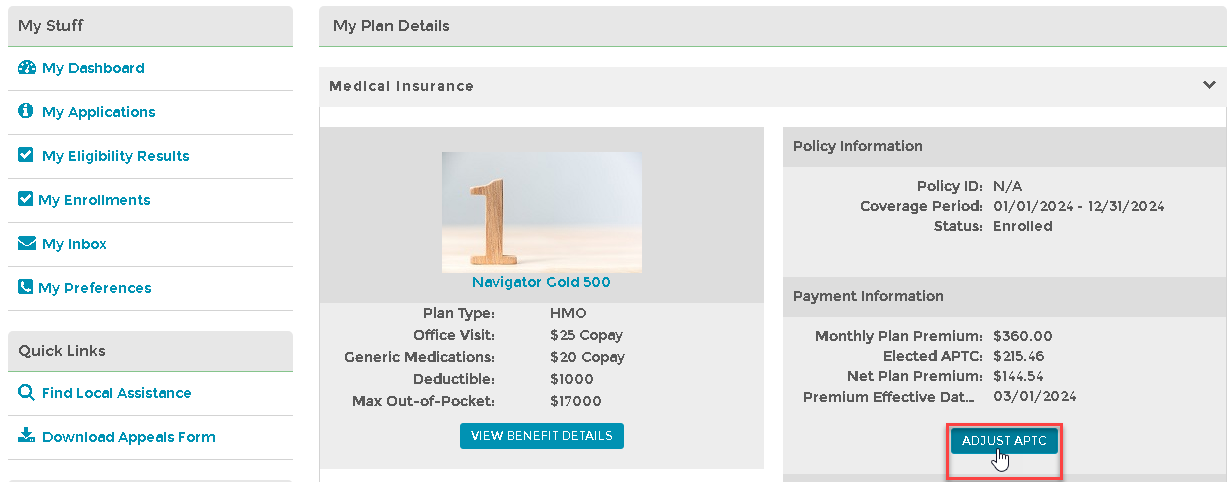

Click Adjust APTC

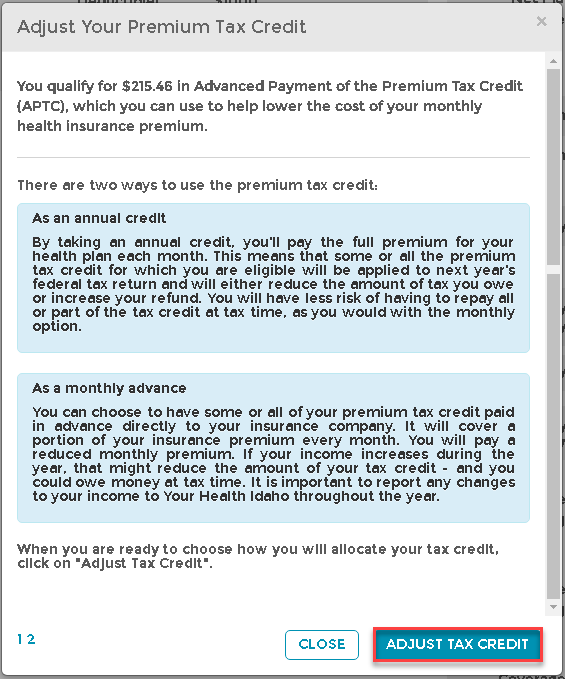

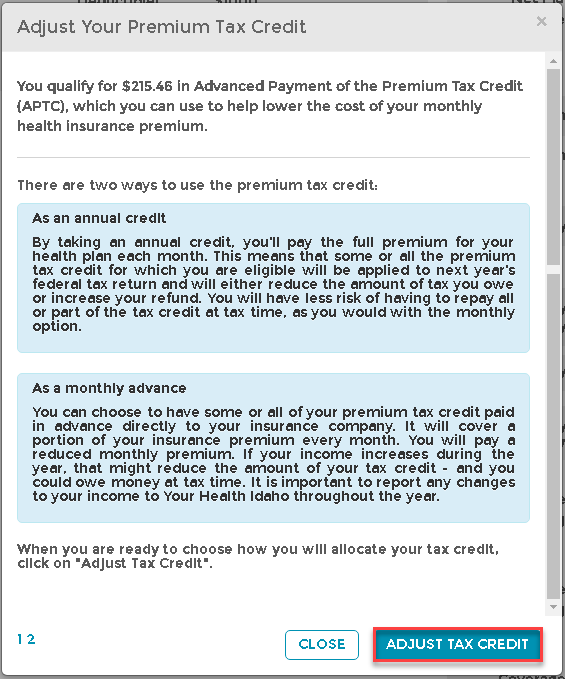

After reviewing the disclaimer, click Adjust APTC.

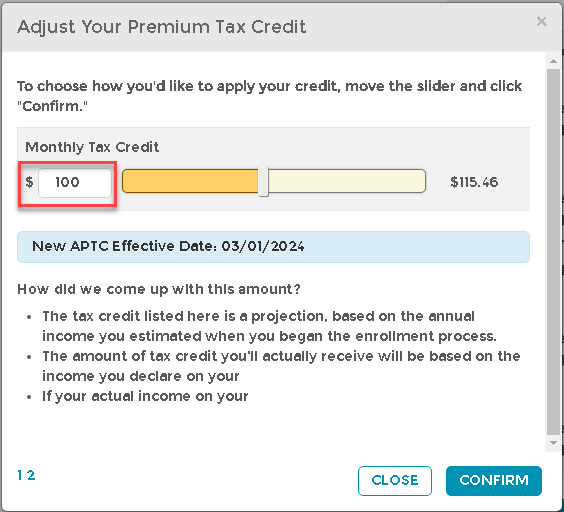

Choose the desired APTC amount you want to apply towards your premium every month going forward by typing into the field on the left of the slider or by dragging the slider either left or right.

TIP: The amount on the right represents the unused monthly amount you can redeem at the end of the tax year.

Once finished, it will return you to your plan details page, where you can see the updated amount of “Elected APTC.”